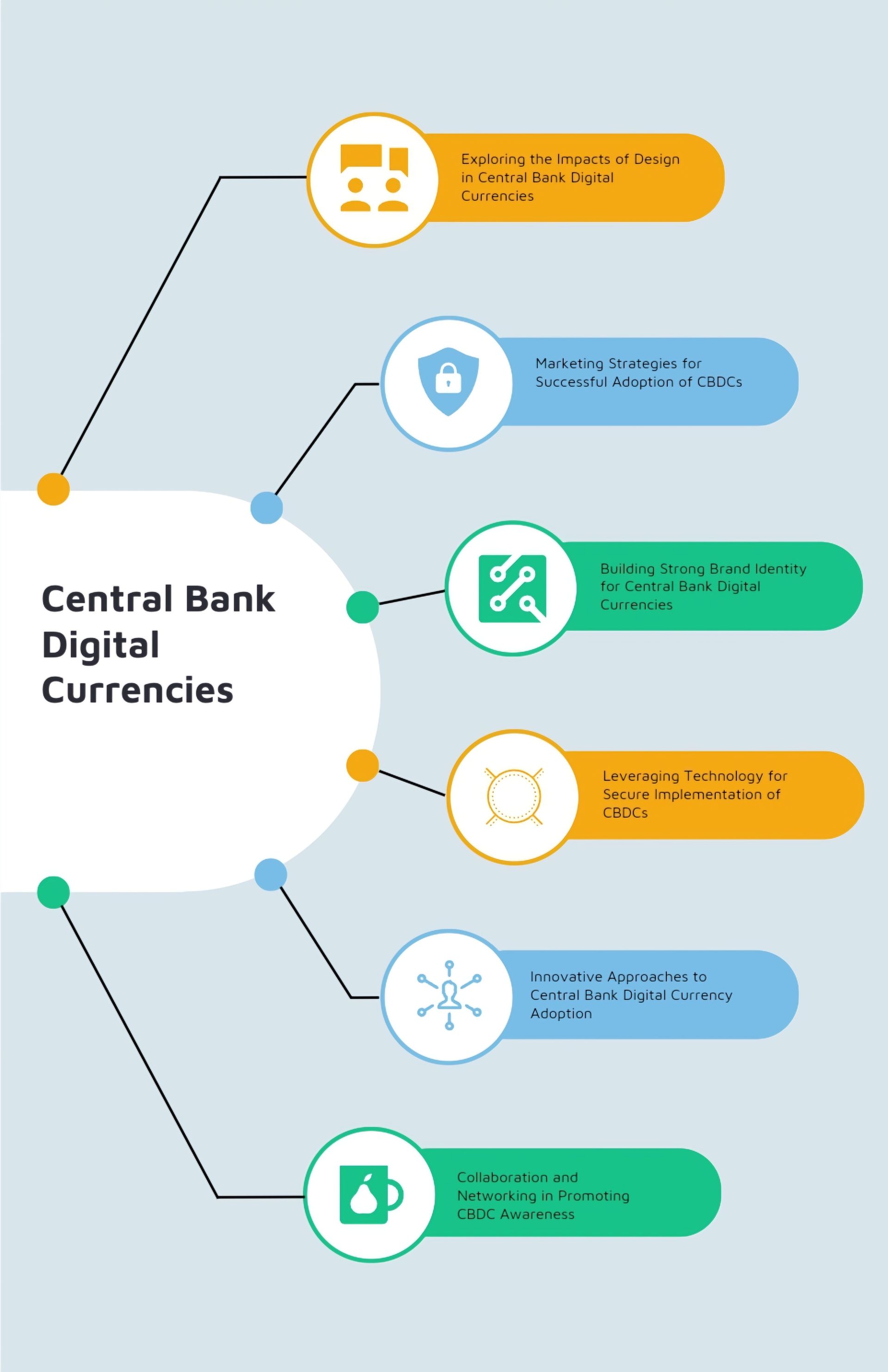

The Design, Marketing, and Branding of Central Bank Digital Currencies (CBDCs)

The significant challenges for CBDC design, advertising techniques that can increase public trust and adoption

Central Bank Digital Currencies (CBDCs) have become a hot issue in the financial world, with more than 60 central banks across the world contemplating creating their own digital currencies. As these initiatives go from concept to implementation, it becomes increasingly vital to address the design, marketing, and branding elements that will influence public perception and acceptance. The following piece discusses the significant challenges for CBDC design and advertising techniques that can increase public trust and adoption, and branding aspects that separate CBDCs from traditional currencies and cryptocurrencies.

Designing CBDCs for Public Trust and Adoption

The architecture of a CBDC is critical for creating confidence and allowing a seamless shift away from traditional means of payment.

The Bank of England's (2021) research emphasises the need of combining macroeconomic objectives with the prevention of financial sector disruption. The design should prioritise a smooth user experience, excellent security, and compatibility with existing payment systems. Furthermore, it is important to analyse the role of CBDCs in fostering financial inclusion, particularly in countries where access to banking services is limited.

Marketing CBDCs: Increasing Trust and Awareness

Effective marketing of CBDCs is critical for increasing public trust and knowledge. The Bank of England's 2021 discussion paper emphasises the significance of consulting with stakeholders and society as a whole to better understand the advantages, dangers, and practicalities of CBDCs. According to a Bank of Canada (2021) poll, the general public knows little about CBDCs, with many respondents concerned about privacy, security, and government oversight. Effective marketing campaigns should educate the public on the benefits of CBDCs, answer their concerns, and emphasise CBDCs' role in supporting financial stability and inclusiveness.

Branding CBDCs: Developing a Unique Identity

Branding is critical for distinguishing CBDCs from regular currencies and cryptocurrencies. The branding approach should centre on developing a distinct identity that connects with the target audience and communicates the benefits of CBDCs. The People's Bank of China's digital yuan, for example, is marketed as a "digital currency for the people," emphasising its role in increasing financial inclusion and reducing dependency on cash. The branding should also take into account visual components such as the logo and colour palette, which will help the CBDC become instantly recognisable and build trust in its users.

CBDCs must be designed, marketed, and branded in a way that balances innovation and trust. By emphasising user-centric design, good communication, and a distinct identity, central banks may establish CBDCs that are generally recognised and trusted by the public. As CBDCs evolve, central banks must stay ahead of the curve by adapting their methods to suit their consumers' shifting requirements and expectations.